Hire Remote Bookkeeper, Accountant , Tax return Preparer or Admin Person

Company Tax return to ATOstarts at $350 - By Certified CA/CPA

Get A Free Quote !

Part Time / Full Time Resources For

- CPA Firms

- Bookkeeping Firms

- Business Owners & Startup Companies

Hire Remote Team

9+

Years Of Success

600+

Happy Clients

1,100+

Completed Project

250k+

Hours Of Experience

20+

Software Used

Below would be the next steps

step 1

Schedule An Introductory Call:

You can schedule a call here. If any of this is not suitable, do let us know your Convenient time. (Mornings are preferable).

Step 2

Understanding your Business & Finalizing Quotation:

Please share your Last 2 months Bank & Credit card statements for us to give you a quote.

We shall send you a fixed price proposal for the work and once the Engagement letter is signed we shall start working.

Step 4

Get Started:

Daily/weekly/monthly work updates as discussed will be sent to you once we start working followed by a Management report.

Below would be the next steps

step 1

Schedule An Introductory Call:

Step 4

Tax Review & Online Filing:

A CPA or EA reviews your tax return, followed by your final approval.

Bookkeeping Software Expertise

Tax return preparation software expertise for CPA firms & Enrolled agents

Our Services

Setting up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance. Hire Remote Bookkeeper - (Multiple options available - Part time/ Full Time/ Permanent/ Temporary).

Day to Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Year End Finalisation

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

Payroll Setup and Processing

This covers filing your Payroll through Single Touch Payroll system, TFN Declaration, Superannuation Return filing, Installment Activity Statement filing & PAYG Calculations.

GST in Australia

We shall reconcile your GST input Credit account and Output liability account.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

Bookkeeping for CPA's

We provide end to end bookkeeping solutions for CPA’s and bookkeepers in the AU.

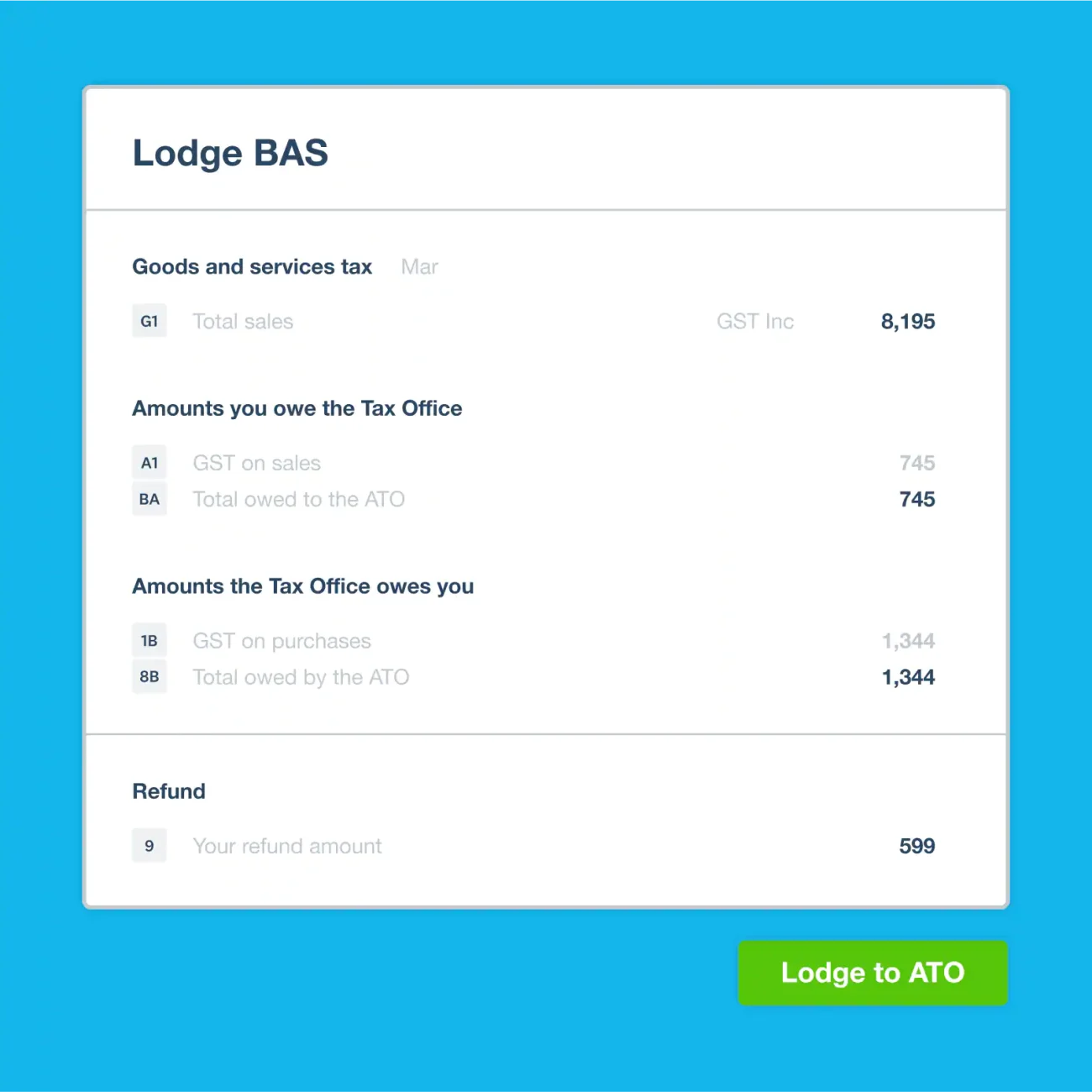

BAS Returns

We deal with BAS very closely for our clients to ensure that GST claim is correctly calculated and Submitted Timely.

Annual Company Tax Return

We shall do your Individual & company Tax filing through your ATO login.

Get a resource within 24 hours from our pool of 320+ professionals

Experience: Ranges from 1-20 years of experience.

Certification: QuickBooks/Xero/ NetSuite/ ICB/ ABA certification

Qualification: Commerce Graduate/ Master’s in commerce or Semi-Qualified CPA.

Industry: Worked with multiple industries for various CPA firms.

Geography: Expert in Australian Bookkeeping.

Data Point: Process 10 Million+ bookkeeping transactions per year.

Experience: Ranges from 3-20 years of experience in Australian Taxation.

Tax Tools: myTax, Drake Tax, Taxwise, Taxdome, Bonsai, ATO, Xero.

Qualification: EA, Indian CPA, Commerce Graduate/ Master’s in commerce or Semi-Qualified CPA.

Tax Returns: Individual Tax Returns, Business Activity Statements (BAS), Company Tax Returns, Self-Managed Superannuation Fund (SMSF) Tax Returns.

Data Point: Prepare 7,500+ tax returns per year.

Experience: Ranges from 4-20 years of experience in Australian GAAP and Australian Accounting Standards Board (AASB)

Type: Reckon, NetSuite, BGL Corporate Solutions, HandiSoft.

Qualification: Indian CPA, Master’s in commerce or Semi-Qualified CPA.

Assignments: Australian GAAP and Australian Accounting Standards Board (AASB) Advisory, Accounting implementation, Accounting policies, Period end accounting & reporting.

Data Point: Prepare 2,500+ financial statements per year.

Experience: Ranges from 2-20 years of experience in Australian Accounting Standards Board (AASB)

Type: Listed/ASX & Non-ASX Audits.

Qualification: Indian CPA, Master’s in commerce or Semi-Qualified CPA.

Each business owner is provided with a Dedicated Accounting team at no additional cost.

Senior Accounts Officer

- Performs all Regular bookkeeping tasks including Payables Processing, Receivables Matching & reporting, Preparing Financial Statements, etc.

- Plans the work to deliver as per clients Expectations since Onboarding call.

- Preparation of Work Methodology & Processes for each tasks

- Prepares Checklists of Information required from client.

- Responsible for sending work updates on all days when file is worked upon.

- Perform Self review of work

- Regular Meeting to discuss Financials with Clients.

Accounts Reviewer

- Ensures Easy onboarding of client.

- Conducts internal review meeting for each of the file.

- Conducts meeting with the client to ensure the work is delivered as per the expectations.

- Acts as an backup for Senior Accounts Officer.

- Checks and reviews various financial documents to ensure Qualitv and Error free of work

Project Coordinator (admin)

- To documents all the Minutes of meeting.

- To create & Assign the tasks as per the clients requirements.

- To Ensure that team keeps their task list most upto date.

- Follow up with clients on requested information through emails and calls every 3 days.

Why are we the 1st choice of AU Businesses for Accounting &

Tax Return Preparation

Experienced and Trained Professionals

With years of industry knowledge and continuous training, our professionals ensure success.

Organized Project Management System

We have a self hosted project management system that helps in communicating with you clearly and manage your project efficiently.

Reduce 50% In Current Costs

Save 40-50% Compared to local Bookkeepers or Accountants

Transparent Processes

We strive to maintain clear and transparent processes to ensure our clients are fully informed and confident in the outcomes.

Faster Turnaround

We typically respond to emails within the same day or within a maximum of 24 hours.

Detailed & Regular Work Updates

Get regular work updates through email containing all the necessary information you need to carry out business operations.

Meetings on the go

Arrange meetings with our experts on the go for effective communication and convey your needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization.

Detailed Checklists

Get a well-defined checklist with all your requirements to avoid any confusion.

High Quality of Work

Our Standardized Procedures and detailed Checklists ensure error-free work.

Cloud AddOns Expertise

Real-Time Bookkeeping Services for Business Owners, CPAs and Bookkeepers in Australia

Meru Accounting is India’s leading accounting and bookkeeping firm, which also provides its services in Australia. We have deep knowledge of laws and legislation that are applied in Australia, which we use for the best outcome of our clients. Doing books for Australian businesses requires a composite knowledge of various laws and legislations applicable in Australia. Businesses need to pay taxes every quarter based on the turnover they do during a period.

Installment Activity Statement: IAS needs to be filed with ATO on monthly basis if ATO requires you to do so.

Business Activity Statement: This needs to be filed generally on quarterly basis for all the businesses which are registered under GST.

Annual Returns: Annual Tax returns needs to be filed by business in Australia.

Australia Follows financial year starting from 01st July to 30th June.

Analysis of Bookkeeping in Australia

HOW WE DEAL WITH

Backlog Accounting

your financial requirements

HOW WE DEAL WITH

Expensify Manual

account of their monetary investments.

MERU ACCOUNTING

Wave-App Manual

monetary investments

MERU ACCOUNRING

Yardi-Breeze

complete account of their

monetary investments

MERU ACCOUNRING

Hubdoc Manual

account of their monetary investments

DOWNLOAD NOW Hubdoc Manual by

CONTACT US FOR ANY QUESTIONS

How to integrate Xero with the Australian Taxation Office (ATO) for Business Activity Statement (BAS) lodgmen

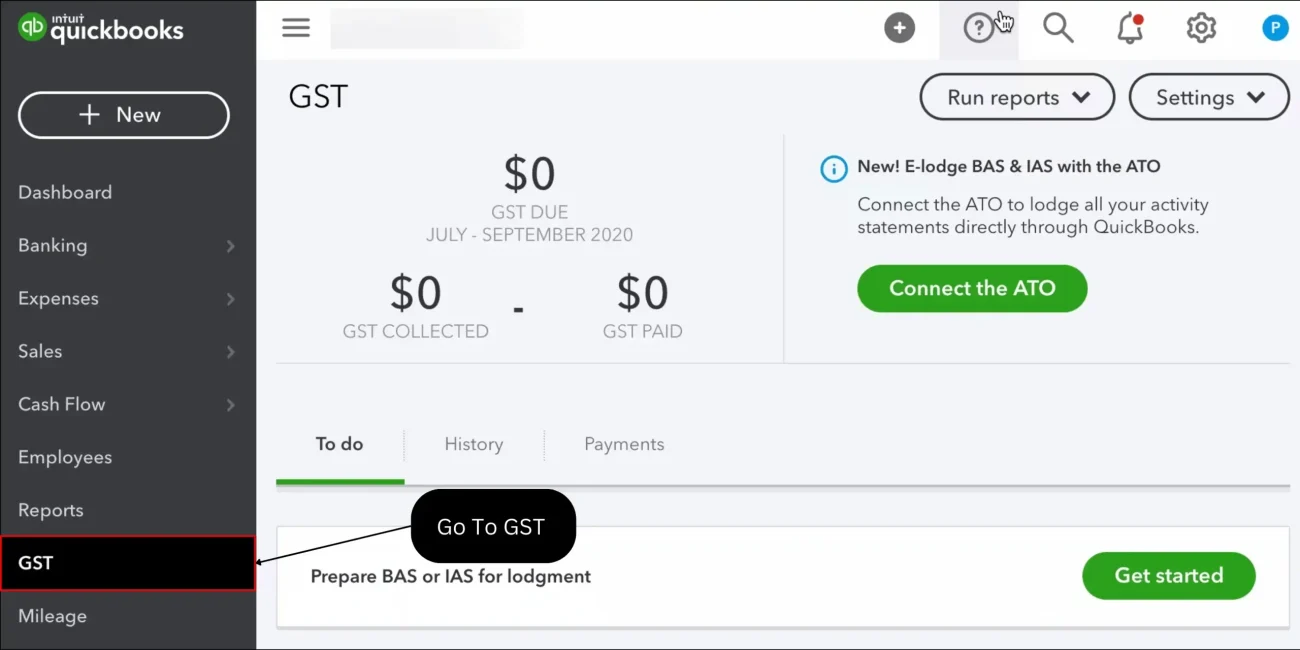

How to Integrate MY GOV with Quickbooks Online to Lodge your Business Activity Statements with ATO