Home » Industries » Non Profit Organizations

Hire Remote Bookkeeper, Accountant , Tax return Preparer or Admin Person

Monthly Bookkeeping, Payroll, Financial Statements & Tax returns for Non-governmental organizations (NGOs) and Social welfare organizations

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Bookkeeping Firms

- Business Owners & Startup Companies

Starting from AUD 700 for 40 hours months

Starting from AUD 2100 for 160 hours months

Hire Remote Team

Bookkeeping software expertise

Our Services

We are a group of professionals who offer accounting and bookkeeping services to our clientele across the AU. We offer standard as well as tailored accounting and bookkeeping solutions based on the specific requirements of our clients, ensuring them the best results with our services.

Setting up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance.

Day to Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Year End Finalisation

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

Payroll Setup and Processing

This covers filing your Payroll through Single Touch Payroll system, TFN Declaration, Superannuation Return filing, Installment Activity Statement filing & PAYG Calculations.

GST in Australia

We shall reconcile your GST input Credit account and Output liability account.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

Bookkeeping for CPA's

We provide end to end bookkeeping solutions for CPA’s and bookkeepers in the AU.

BAS Returns

We deal with BAS very closely for our clients to ensure that GST claim is correctly calculated and Submitted Timely.

Annual Company Tax Return

We shall do your Individual & company Tax filing through your ATO login.

Why are we the 1st choice of AU Businesses for Accounting & Tax Return Preparation

Reduce 50% in Current Costs

You will see a Cost reduction of at least 40-50% as compared to local Bookkeeper or Accountant.

Self Hosted PMS

Our standardized processes and decent Project Management system helps to communicate with you clearly and efficiently.

Faster Turnaround

We generally reply to every emails same day or within maximum 24 hours.

Starting from

US $10 Per Hour Bookkeeping service

Detailed & Regular Work Updates

We send emails that carry all the necessary information you need to carry out business operations.

Monthly Meetings with CPA

We conduct monthly meetings with CPA’s for effective communication and understanding client needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization. .

Detailed Checklists

We prepare a well-defined checklist of all the requirements for you so that you don’t have any confusion.

High Quality of Work

Our Standardized Procedures and Checklists will ensure error free work. .

Cloud AddOns Expertise

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Gusto

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

Accounting and Bookkeeping for non-profit organizations in Australia

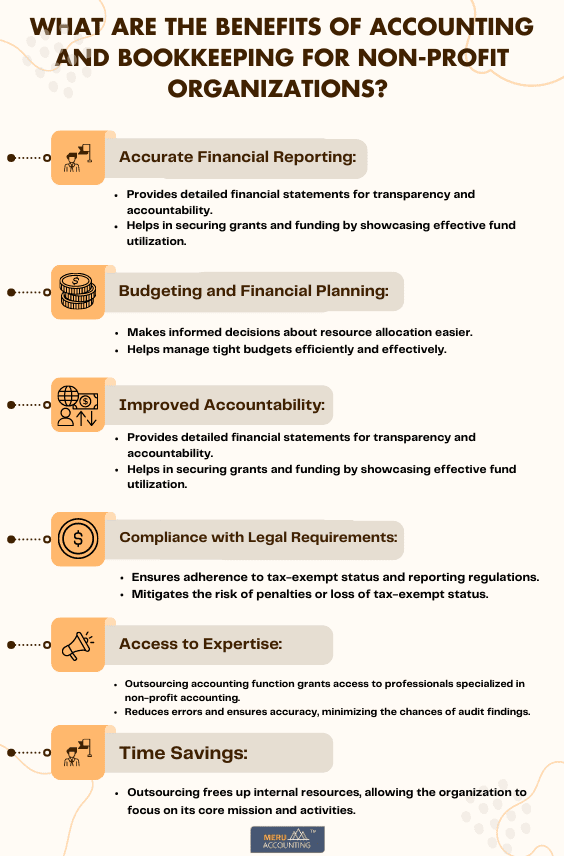

Whether you’re a small community group or a large charitable organization, effective financial management is crucial to the success of your cause. There are a lot of benefits of Accounting and Bookkeeping for non-profit organizations in Australia. From understanding the benefits to setting up a system and choosing the right software, we will explore everything.

Accounting for Non-profit Organizations – Non-profit organizations do not have business proprietors and thus, they depend on reserves from commitments, participation contributions, program incomes, money-raising occasions, open and private awards, and venture salaries. So, accounting and bookkeeping of non-profit organizations is different. Let’s understand the significance of accounting and bookkeeping in non-profit organizations and explore its benefits.

Significance Aspects of Accounting for Non-profit Organizations

-

Taxability of Donations Received:

Non-profit organizations must meticulously record all donations they receive and the sources of those donations. While non-profits are generally exempt from income tax, there may be specific rules regarding certain types of income like property income or capital gains. -

Different Types of Donations:

Non-profit organizations need to classify donations based on their restrictions or lack thereof to manage and allocate funds properly.- Unrestricted commitment incomes: If the giver does not express the reason for commitment, then it will come under unhindered commitment incomes.

- Temporarily restricted net assets: If the giver specifically states the use of the donation, it would go under temporarily restricted net assets.

- Permanently restricted net assets: These donations are such that the receiver can never use them in perpetuity at any point in time.

-

Accounting for Expenses:

Expenses vs Expenditure done - Accounting of the expenses which are done for the long run that can be en-cashed, and the cost incurred to meet every day and current financial needs of the business, generally for a short term is dealt with.

-

Spending from Corpus:

The spending from the whole collection of donations accounts for a specific reason. -

Budgeting:

Creating and managing budgets is crucial for non-profit organizations to plan their financial activities effectively.- Approval of budgets by trustees- A budget is an estimation of revenue and expenses over a specified future period. It is then approved by the trustees of the non-profit organization after a timely review of financial reports and planning.

- Spending vs budgeting reports- The budget report is made by trustees and the annual spending report is compared, and then a balance is made of all the spending.

-

Balance Sheet:

The balance sheet is a financial statement that summarizes all the assets, liabilities, and capital of a particular company at a specific period. It also shows all the amount that the company invested in a certain project, the amount of money it owns and owes. The organizations prepare their balance sheet so they can know their financial position. They prepare it by taking assets and liabilities and also fund-based items into consideration.

What are the different types of accounting and bookkeeping software available?

Here are the different types of accounting and bookkeeping software available for non-profit organizations:

- Accessible from anywhere with an internet connection, suitable for organizations with multiple locations or remote workers.

- Often includes features like invoicing, expense tracking, and budgeting tools.

- Allows real-time collaboration and data sharing among team members.

- Installed directly onto your computer, providing similar functionality to cloud-based options.

- Data is stored locally on your device, which may offer additional security for sensitive financial information.

- Designed as per the needs of non-profit organizations.

- Includes features like fund tracking, grant management, and reporting for tax-exempt status.

- Streamlines financial management for non-profits with unique accounting requirements.

- Offers freely available source code, allowing users to modify and customize the software to suit their needs.

- Can be a cost-effective option for smaller non-profits with limited budgets.

- Requires technical expertise for installation and customization.

- Comprehensive solutions that combine various business functions like accounting, payroll, and customer management in one platform.

- Offers seamless data integration and eliminates the need for multiple standalone systems.

- Designed specifically for organizations that manage multiple funding sources and need to track funds separately.

- Provides detailed reports on fund usage and compliance.

- Integrates accounting with donor management, facilitating fundraising and donor tracking.

- Helps manage donor contributions and automate receipt generation.

- Provides the convenience of managing finances on the go via mobile devices.

- Often includes basic accounting features suitable for small non-profits.

How to choose the right accounting and bookkeeping software for your non-profit organization?

Choose the right accounting and bookkeeping software for your non-profit organization:

- Ensure the software is specifically designed for non-profit organizations.

- Look for features such as fund tracking, grant management, and reporting for tax-exempt status.

- Choose software with intuitive navigation and a user-friendly interface

- Consider the ease of learning and using the software, especially for staff members with limited accounting knowledge.

- Select a software solution that can accommodate your non-profit’s future growth and increasing accounting needs.

- Avoid solutions that may require costly upgrades or migrations as your organization expands.

- Verify that the software can seamlessly integrate with other systems your non-profit uses, such as fundraising platforms or donor management tools.

- Integration helps streamline processes and reduces the likelihood of manual data entry errors.

- Consider both upfront costs, such as licensing fees, and ongoing expenses like maintenance or subscription charges.

- Evaluate the value software provides about its cost.

- Look for a software provider that offers excellent technical assistance via phone, email, or live chat.

- Responsive customer support is essential when you encounter issues or have questions about using the software.

- Ensure that the software has robust security measures to protect your non-profit’s sensitive financial data.

- Check for features like data encryption, regular backups, and secure user access controls.

- Read reviews and testimonials from other non-profit organizations that have used the software.

- Feedback from other users can give you insights into the software’s strengths and weaknesses.

- Non-profit organizations can benefit from utilizing free trials or demos offered by software providers to explore and evaluate the software before making a decision.

- Test the software yourself to see if it meets your organization’s requirements before committing to a purchase.

Outsourced Bookkeeping for Nonprofits

Bookkeeping for nonprofit organizations has become simple and easy with outsourcing. Outsourced bookkeeping for nonprofits is the ultimate solution to enhance the financial stability of nonprofits in Australia. The complex nature of bookkeeping for nonprofit organizations, with its unique accounting requirements and regulatory complexities, requires a specialized approach. Bookkeeping for nonprofits can be simplified by harnessing the power of outsourcing. Leveraging outsourced accounting for nonprofits not only ensures precise management of financial records but also frees up valuable time and resources to focus on the other essential tasks.

Meru Accounting has years of experience in bookkeeping for nonprofits. We offer a customized approach to bookkeeping for nonprofit organizations. With modern accounting software and expert professionals, we deliver exceptional solutions to streamline your financial operations. Outsourced accounting for nonprofits can help in transparent reporting, informed decision-making, and greater financial accountability. Manage the complexities of financial management with Meru Accounting and achieve long-term sustainability.

How can you keep your bookkeeping perfect?

Here are some tips for Non-profits to keep their Bookkeeping perfect:

- Approval of IRS: If the IRS approves it, the income of a non-profit entity is exempt from federal income tax.

- Taxability of Donation Received: Donations received by Nonprofit is exempt and no tax is payable on the same.

- Sales tax and state-level taxes: It is mandatory for Non-Profits too, to pay sales tax and other taxes based on state-level requirements.

- Employment Tax: Even when exempt under federal income tax, Non-Profits also need to pay employment tax.

Conclusion

Meru Accounting, as a specialized accounting service provider, plays a crucial role in supporting non-profit organizations in Australia. Its expertise in accounting and bookkeeping helps non-profits maintain accurate financial records and ensure compliance with financial regulations. For non-profits, handling financial matters can be complex and time-consuming. By outsourcing their accounting needs to Meru Accounting, they can focus on their core mission and programs while leaving the financial management to the experts. Meru Accounting understands the unique challenges faced by non-profits and provides tailored solutions that meet their specific needs.

Meru Accounting offers services using modern accounting software and tools that streamline financial operations and provide comprehensive functionality. This allows non-profits to have better control over their finances, make informed decisions, and present transparent financial reports to donors and stakeholders. With Meru Accounting’s support, non-profit organizations can optimize their financial management, track expenses, and manage funds efficiently. By maintaining accurate financial records, they can build trust among donors and stakeholders, showcasing their commitment to financial accountability and transparency.

By collaborating with Meru Accounting, non-profit organizations can benefit from the expertise of dedicated professionals who have extensive experience in handling the financial intricacies of non-profit organizations. This partnership empowers non-profit organizations to focus on their core mission, making a positive impact in the community, while leaving the financial complexities to the capable hands of Meru Accounting. As a result, non-profit organizations can achieve long-term sustainability and success in fulfilling their noble causes.

Accounting for Nonprofit Organizations

Accounting for Nonprofit Organizations – From houses of worship to youth associations to neighbourhood assemblies of business, not-for-profit associations make our groups more bearable spots.

Not-for-profit organizations do not have business proprietors and thus, they depend on reserves from commitments, participation contributions, program incomes, money raising occasions, open and private awards, and venture salaries.

We intend to introduce some basic concepts distinctive to non-profit accounting.

Significant aspects of accounting for non-profit organizations:

Taxability of the donation received: It gives a detailed look of all the donations they took for the course of a year. It is very important that non-profit organizations keep a record of the donations they take in and from whom they accept. Although non-profits are exempt from paying income tax, except for a few rules for property income or capital gains.

Different donations received:

Unrestricted commitment incomes: If the giver does not express the reason for commitment, then it will come under unhindered commitment incomes.

Temporarily restricted net assets:If the giver specifically states the use of the donation, it would go under temporarily restricted net assets.

Permanently restricted net assets:These donations are such which the receiver can never use in perpetuity at any point of time.

Accounting for Expenses:

Expenses vs Expenditure done- Accounting of the expenses which are done for the long run that can be en-cashed, and the cost incurred to meet every day and current financial needs of the business, generally for a short term is dealt with.

Spending from Corpus:

The spending from the whole collection of donations accounts for a specific reason.

Budgeting

- Approval of budgets by trustees- A budget is an estimation of revenue and expenses over a specified future period. It is then approved by the trustees of the non-profit organization after a timely review of financial reports and planning.

- Spending vs budgeting reports- The budget report is made by trustees and the annual spending report is compared, and then a balance is made of all the spending.

Here are some tips for Non-profits to keep their Bookkeeping perfect!

Approval of IRS

The income of a non-profit entity is exempt from federal income tax if the IRS approves it.

Taxability of Donation Received

Donation received by Nonprofit is exempt and no tax is payable on the same.

Sales tax and state-level taxes

It is mandatory for Non-Profits too, to pay sales tax and other taxes based on state-level requirements.

Employment Tax

Non-Profits also need to pay employment tax even when they are exempt under the federal income tax.

Balance Sheet

The balance sheet is a financial statement that summarizes all the assets, liabilities and capital of a particular company at a specific period. It also shows all the amount that the company invested in a certain project, the amount of money it owns and it owes.

The organizations prepare their balance sheet so they can know the financial position. They prepare it by taking assets and liabilities and also fund based items into consideration.

Meru Accounting is a well-known accounting firm. We specialize in maintaining accounts for non-profit organizations.

To know more about our pricing and services, contact us today!

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Bookkeeping for CPA(s)

Certified public accountants or CPAs are known as backbones of a business firm. They help a business to survive and stand in the market. They are financial experts. Their stronghold at accounting, taxation, and finance makes them feel that they don’t require any bookkeeping service to keep a check on all the updates and paperwork.

CPA(s) are very knowledgeable. But spending their time in compilation and updation of paperwork is not a part of their job. They can efficiently invest this time in looking up for new clients and strengthening of already made tie-ups with multiple business firms. CPA(s) often live under the misunderstanding that they need not hire a professional and invest extra money on bookkeeping.

This is an actual myth these days. Having a personalized bookkeeping service improvises the accountant’s productivity. Your work gets more organized and stays updated. Outsourcing accountant experts are well updated with all the latest technologies that are needed to thrive in the industry.

As an accountant, you shall have peace of mind if you know that your accounting processes are in safe hands. Your data is being accessed using the latest technologies. This becomes a major strength when your motto is to work with the maximum no. of clients.

A good bookkeeping service will know about software like Freshbooks, SageOne, Wave, Xero, Quickbooks, etc. When your accounts are with an expert, who is not just mending for paperwork, you are good to go. All these benefits prove the need for bookkeeping for a CPA’s growth and easy work processing.

The acronym CPA stands for Certified Public Accountants. A CPA is a certification issued by the American Institute of Certified Public Accountant (AICPA). A person certified as CPA acts as a financial advisor with a high degree of knowledge and experience in the field of accountancy. This certification is mostly preferred by the CA, CS, MBA Cost accountant, financial advisors for professional recognition.

CFA stands for Certified Financial Analyst certified by CFA institute whereas CPA stands for Certified Public Accountant certified by AICPA. The purpose CFA is to analyses different financial option and provides investments options to the key financial planner and upper management of investment companies, whereas CPA is trained accountant professional who assists in various accounting service and taxation. We can say CFA act as financial analyst whereas the role of the CPA is of a facilitator of the accounting process.

If an individual, business, firm, or organization needs help for the preparation of tax, they should hire a CPA. If they need assistance for financial planning and investment, then should hire a CFA.

The three E(s) of CPA are Education, Examination and Experience. These 3 E(s) are necessary to get licenses for CPA. Only passing out examination doesn’t make you eligible for a CPA license, you need to meet sufficient requirements to get a license. Contact to this site for more details https://www.aicpa.org/becomeacpa/cpaexam.html

An individual, business, or any organization needs assistance in finance, accounting and business require a CPA. A qualified CPA provides professional expertise and advice to your business.

CONTACT US FOR ANY QUESTIONS

Our Office Address

AU Office

Level 8/350 Collins Street, Melbourne VIC 3000, Australia

902, Shivalik Tower, Nr. Panchvati Cross Roads, Ahmedabad, Gujarat 380009, India