How to integrate Xero with the Australian Taxation Office (ATO) for Business Activity Statement (BAS) lodgmen

follow these steps:

Set Up Xero for BAS Lodgement

- Before you can lodge your BAS, you need to ensure that your Xero organization is correctly set up with your GST details.

- Go to Settings > General Settings > Financial settings.

- Ensure that GST settings are filled out properly, including your GST accounting basis (cash or accrual) and GST registration date.

Enable ATO Reporting in Xero

- In the Accounting menu, select Advanced

- Under Advanced settings select Financial settings.

- Click Go to new BAS.

- (Optional) Click Learn more about Connected BAS.

- You’ll be presented with the connection setup prompt.

- Click Lodge reports directly from Xero and follow the onscreen instructions. These include the software ID (SSID) you need to give to the ATO.

- Call the ATO to authorize the connection.

- When the ATO have activated your account, click Check connection and get activity statements so Xero can confirm the connection.

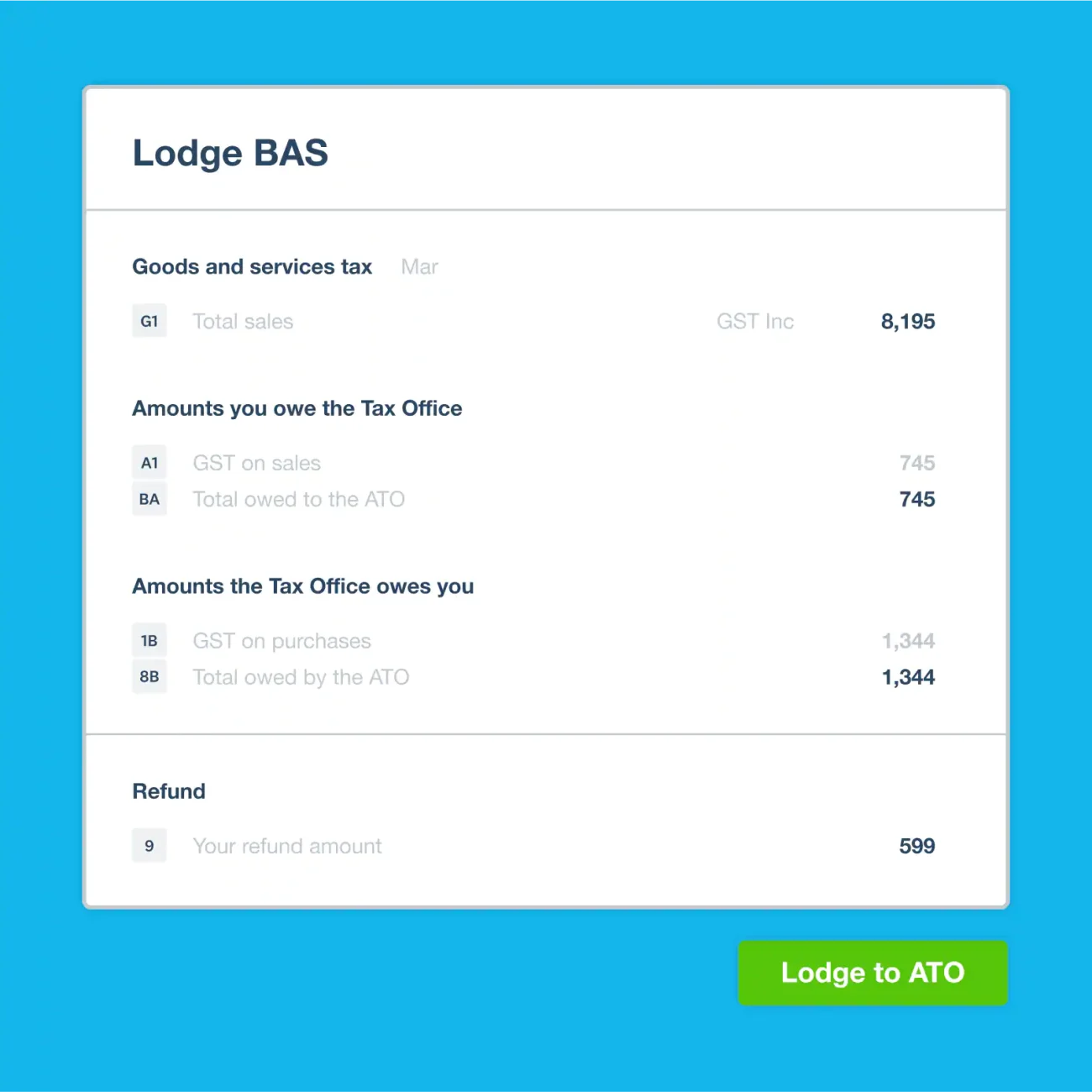

Prepare Your BAS in Xero

- Xero automatically generates BAS reports based on the financial data you’ve entered.

- Go to Accounting > Reports > Activity Statements.

- Select the appropriate BAS period and check that your GST amounts are correct.

- Xero will pull in your sales and purchase information to fill in the necessary sections, such as G1 (Total Sales), G11 (Non-Capital Purchases), etc.

- Ensure that GST on sales and GST on purchases are categorized correctly.

Review and Lodge BAS via Xero

- Once your BAS is prepared:

- Go to Reports > Activity Statements.

- Click Prepare BAS.

- Review the statement to ensure all information is correct.

- If everything is accurate, click File Now to lodge it directly to the ATO.

- You’ll be prompted to authenticate with your MyGovID credentials.

Once submitted, Xero will confirm if the lodgement was successful.

- Level 8/350 Collins Street, Melbourne VIC 3000, Australia

- +61 8 7150 1402

SERVICES

© 2013-2026 Meru Accounting. All Rights Reserved.

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

This will close in 0 seconds

Calendly

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

This will close in 0 seconds

Office Video

This will close in 0 seconds

QBOGOV

This will close in 0 seconds