How to integrate Xero with the Australian Taxation Office (ATO) for

Single Touch Payroll (STP)

follow these steps:

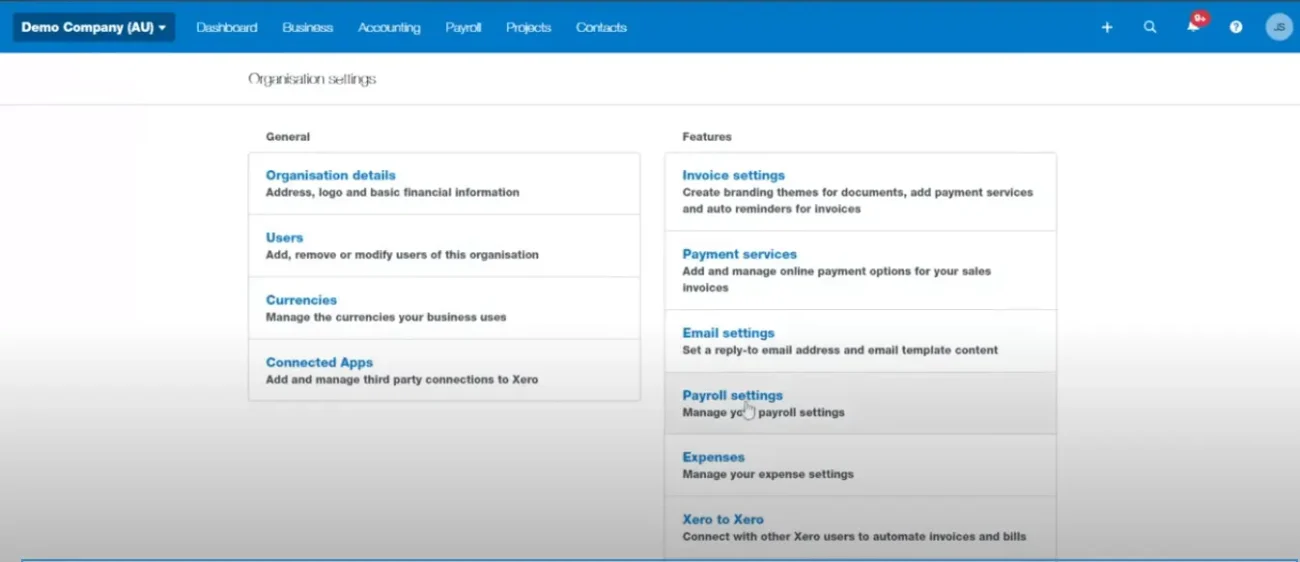

1. Enable Payroll in Xero

If you haven't already, enable payroll in your Xero account.

- Go to Settings > Payroll settings > Organisation > Payroll settings.

- Ensure the Organisation details are filled out correctly, as they are required for reporting.

2. Register for STP with ATO

- You need to notify the ATO that you’ll be reporting through Xero

- Contact the ATO or register through the ATO Business Portal.

- Add Xero as your Software Service ID (SSID) with the ATO:

- Go to Payroll > Payroll settings > Electronic filing.

- Find your SSID, which you'll use to register with the ATO

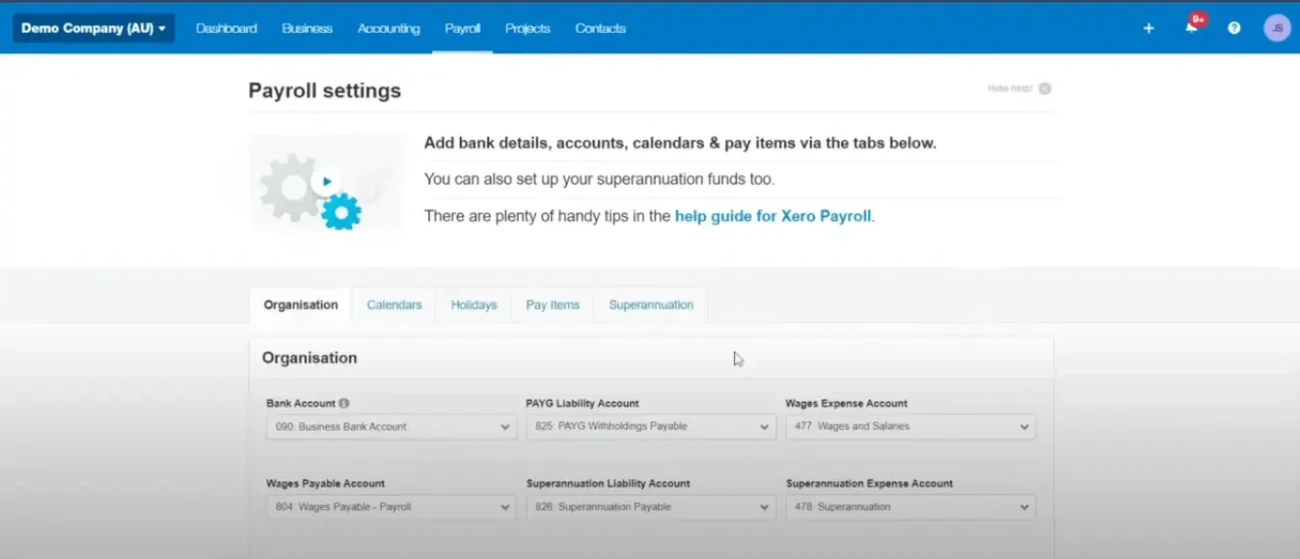

3. Set Up Your Payroll Settings in Xero

– Make sure your employees’ details are accurate and complete, including:

Tax File Number (TFN)

Superannuation details

Pay items

- Verify that superannuation funds are linked correctly for compliance.

4. Activate STP Reporting in Xero

- Go to Payroll > Single Touch Payroll > STP Settings.

- Enable STP and complete the required fields, including the ATO Contact details.

- Once activated, Xero will automatically send payroll information to the ATO each time you process payroll.

5. Process Payroll and File STP Reports

- When you process payroll, Xero will generate an STP filing for each pay run.

- After completing the pay run:

- Go to Payroll > Single Touch Payroll.

- Review the details and submit the report to the ATO.

6. Manage STP Submissions

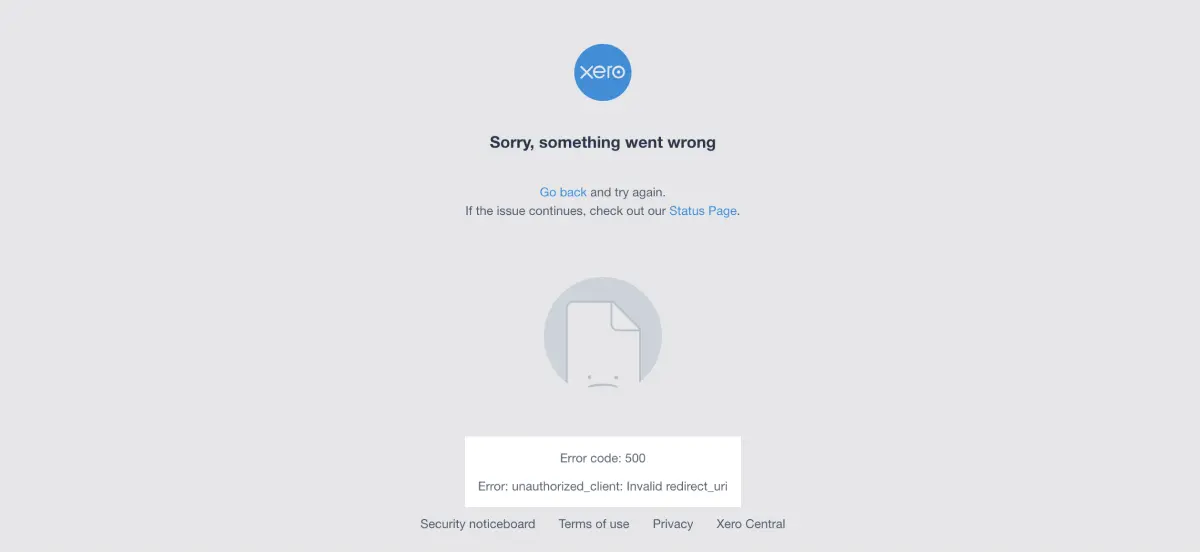

If any submissions are rejected, Xero will notify you of the error. You can correct the issue and resubmit.

- Level 8/350 Collins Street, Melbourne VIC 3000, Australia

- +61 8 7150 1402

SERVICES

© 2013-2026 Meru Accounting. All Rights Reserved.

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

This will close in 0 seconds

Calendly

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

This will close in 0 seconds

Office Video

This will close in 0 seconds

QBOGOV

This will close in 0 seconds