$15

Per Hour Bookkeeping Service

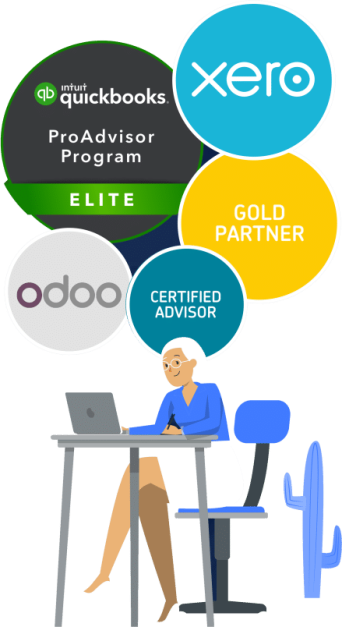

Remote Bookkeeping & Accounting Services for every business Owners, Chartered Accountants, CPA firms & Bookkeepers.

Quality Driven Approach

QuickBooks and Xero Certified Experts

50% Reduction

in Costs

Bookkeeping software expertise

saasu

intuit QuickBooks

netsuite

wave

Freshbooks

odoo

Xero Gold Partner

zoho books

simply accounting by sage

yendo

Our Services

We are a group of professionals who offer accounting and bookkeeping services to our clientele across the AU. We offer standard as well as tailored accounting and bookkeeping solutions based on the specific requirements of our clients, ensuring them the best results with our services.

Setting up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance.

Day to Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Year End Finalisation

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

Payroll Setup and Processing

This covers filing your Payroll through Single Touch Payroll system, TFN Declaration, Superannuation Return filing, Installment Activity Statement filing & PAYG Calculations.

GST in Australia

We shall reconcile your GST input Credit account and Output liability account.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

Bookkeeping for CPA's

We provide end to end bookkeeping solutions for CPA’s and bookkeepers in the AU.

BAS Returns

We deal with BAS very closely for our clients to ensure that GST claim is correctly calculated and Submitted Timely.

Annual Company Tax Return

We shall do your Individual & company Tax filing through your ATO login.

Why are we the 1st choice of A.U. Businesses

Reduce 50% in Current Costs

You will see a Cost reduction of at least 40-50% as compared to local Bookkeeper or Accountant.

Self Hosted PMS

Our standardized processes and decent Project Management system helps to communicate with you clearly and efficiently.

Faster Turnaround

We generally reply to every emails same day or within maximum 24 hours.

Starting from

AU $15

Per Hour Bookkeeping service

Detailed & Regular Work Updates

We send emails that carry all the necessary information you need to carry out business operations.

Monthly Meetings with CPA

We conduct monthly meetings with CPA’s for effective communication and understanding client needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization. .

Detailed Checklists

We prepare a well-defined checklist of all the requirements for you so that you don’t have any confusion.

High Quality of Work

Our Standardized Procedures and Checklists will ensure error free work. .

Cloud AddOns Expertise

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Gusto

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

Real-time Bookkeeping Services to the Australia

Meru Accounting is India’s leading accounting and bookkeeping firm, which also provides its services in Australia. We have deep knowledge of laws and legislation that are applied in Australia, which we use for the best outcome of our clients. Doing books for Australian businesses requires a composite knowledge of various laws and legislations applicable in Australia. Businesses need to pay taxes every quarter based on the turnover they do during a period.

Installment Activity Statement: IAS needs to be filed with ATO on monthly basis if ATO requires you to do so.

Business Activity Statement: This needs to be filed generally on quarterly basis for all the businesses which are registered under GST.

Annual Returns: Annual Tax returns needs to be filed by business in Australia.

Australia Follows financial year starting from 01st July to 30th June.

GST in Australia

Who? When? and How? Are the three most prominent questions to prop in your mind while working on GST registration, click here to read more.

Meru Accounting Australia

A Bookkeeper not only segregates your data, but they also presents you a sorted platter. One glance through the sheet and you can find the right information. It is our vast experience of accounting and bookkeeping that gives us the edge at keeping your books perfect.

Bookkeeping is an art! Like any other form of art, it gets better with practice. Our experience of more than five years making us one of the best virtual bookkeeping service providers.

Being India’s leading bookkeeping and tax return firm, we believe in easy dealing with our clients for which we provide a set of an initial checklist of documents required from you. Your documents are safe with us. We remain in touch with our clients via various online platforms.

Being your virtual bookkeeper, it is essential that the book shall be easily available to you at all times. Meru Accounting provides cloud-based accounting on Quickbooks, Xero, etc. We are a certified silver partner with Xero.

We guide our clients at quality bookkeeping and also assist them by providing various financial reports. Let us do your bookkeeping, so you can run your business well.