Home » Industries » Manufacturing

Hire Remote Bookkeeper, Accountant , Tax return Preparer or Admin Person

Monthly Bookkeeping, Payroll, Financial Statements & Tax returns for Manufacturing and Production Companies

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Bookkeeping Firms

- Business Owners & Startup Companies

Starting from AUD 700 for 40 hours months

Starting from AUD 2100 for 160 hours months

Hire Remote Team

Bookkeeping software expertise

Our Services

We are a group of professionals who offer accounting and bookkeeping services to our clientele across the AU. We offer standard as well as tailored accounting and bookkeeping solutions based on the specific requirements of our clients, ensuring them the best results with our services.

Setting up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance.

Day to Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Year End Finalisation

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

Payroll Setup and Processing

This covers filing your Payroll through Single Touch Payroll system, TFN Declaration, Superannuation Return filing, Installment Activity Statement filing & PAYG Calculations.

GST in Australia

We shall reconcile your GST input Credit account and Output liability account.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

Bookkeeping for CPA's

We provide end to end bookkeeping solutions for CPA’s and bookkeepers in the AU.

BAS Returns

We deal with BAS very closely for our clients to ensure that GST claim is correctly calculated and Submitted Timely.

Annual Company Tax Return

We shall do your Individual & company Tax filing through your ATO login.

Why are we the 1st choice of AU Businesses for Accounting & Tax Return Preparation

Reduce 50% in Current Costs

You will see a Cost reduction of at least 40-50% as compared to local Bookkeeper or Accountant.

Self Hosted PMS

Our standardized processes and decent Project Management system helps to communicate with you clearly and efficiently.

Faster Turnaround

We generally reply to every emails same day or within maximum 24 hours.

Starting from

US $10 Per Hour Bookkeeping service

Detailed & Regular Work Updates

We send emails that carry all the necessary information you need to carry out business operations.

Monthly Meetings with CPA

We conduct monthly meetings with CPA’s for effective communication and understanding client needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization. .

Detailed Checklists

We prepare a well-defined checklist of all the requirements for you so that you don’t have any confusion.

High Quality of Work

Our Standardized Procedures and Checklists will ensure error free work. .

Cloud AddOns Expertise

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Gusto

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

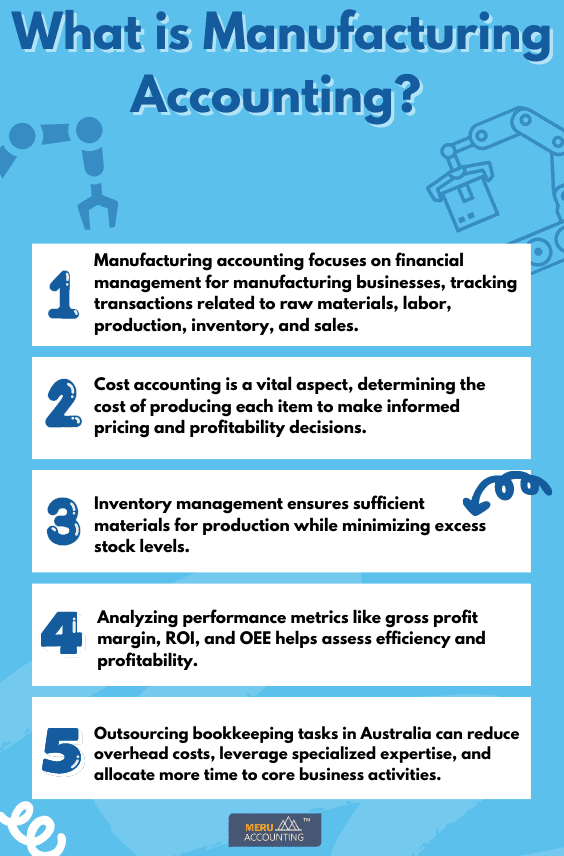

Bookkeeping and accounting for manufacturing business in Australia

Manufacturers play a significant role in the economy of any country. Many other businesses rely on manufacturers to commence their business. Hence, it becomes very necessary that the financial records are properly maintained by the manufacturers.

If you’re a manufacturer in Australia looking to streamline financial processes, improve efficiency, and gain valuable insights into your business’s performance, having a professional accounting or bookkeeping firm by your side is a must. We will explore different types of manufacturing businesses and discuss how outsourcing or offshoring your accounting can help you.

Accounting for Manufacturing Businesses – It is no different than any other business

Wholesalers or retailers stock goods and supply them to the customers. However, manufacturing industries make new items using raw materials from scratch. Hence, inventory management, accounting, and bookkeeping are very critical in manufacturing industries. Manufacturing organizations need to represent their crude materials and preparation costs. Yet, they additionally need to work out the estimation of the completed things they make. Accounting for Manufacturing Businesses involves inventory valuation and the cost of goods sold. In summary, accounting for manufacturing businesses is much more detailed for a business that maintains no inventory.

Accounting for Patterns – A company can record this workload by accounting for the amount of inventory on hand, encouraging suppliers to own some on-site inventory, employing supplier drop shipping, and on the other hand, accounting also reduces the overall level of investment in manufacturing industries.

The accounting required in the manufacturing industry is as follows:

- Direct cost accounting: In this, we assign accounting for costs to inventory using either a standard costing, weighted-average cost, or cost layering method.

- Overhead cost accounting: We must aggregate the Factory Overhead costs into cost pools. Then, allocate it to the number of units produced during a reporting period, which increases the recorded cost of inventory. We should minimize the number of cost pools to reduce the amount of allocation work by the accountant.

- Cost of goods sold (COGS) Recognition: To calculate the basic cost of goods sold, we need the sum of the beginning of inventory and purchases minus the ending inventory. Thus, accounting for the cost of goods sold is driven by the accuracy of the inventory valuation procedures.

- Other costs accounting: Also, we do not record any abnormal expenses incurred, such as excessive scrap, in the inventory.

What type of software is used for manufacturing industries in Australia?

In Australia, manufacturing businesses utilize a variety of software for bookkeeping and accounting to streamline financial operations and comply with regulatory requirements. Some of the commonly used software for bookkeeping and accounting in manufacturing businesses in Australia include:

Xero is a popular cloud-based accounting software used widely by small and medium-sized businesses, including manufacturing companies in Australia. It offers features for invoicing, inventory tracking, bank reconciliation, expense management, and financial reporting.

MYOB is another widely used accounting software in Australia, catering to businesses of various sizes. It provides bookkeeping features, payroll processing, inventory management, and extensive reporting capabilities.

QuickBooks Online is a well-known accounting software used by manufacturing businesses to manage their financial transactions, invoices, and expenses, and track inventory.

Sage offers accounting software designed to cater to the needs of different industries, including manufacturing. It provides features like invoicing, inventory tracking, project costing, and bank reconciliation.

Reckon offers various accounting software products suitable for different business sizes and industries, including manufacturing. It provides features for bookkeeping, payroll processing, and inventory management.

SAP Business One is an ERP software widely used in manufacturing companies in Australia. It integrates various business processes, including accounting, inventory management, production planning, and supply chain management.

As part of the Microsoft Dynamics suite, Dynamics 365 offers ERP solutions that cater to manufacturing businesses’ specific needs. It includes features for financial management, inventory tracking, production planning, and customer relationship management.

NetSuite is a cloud-based ERP software known for its scalability and versatility. It is used by manufacturing companies for financial management, inventory control, order processing, and supply chain management.

Fishbowl is a popular inventory management software that integrates with various accounting systems like QuickBooks, Xero, and MYOB. It offers advanced inventory tracking and manufacturing functionalities.

SAP S/4HANA is an advanced ERP system used by larger manufacturing enterprises in Australia. It provides real-time analytics, financial management, supply chain optimization, and manufacturing planning.

The benefits of Accounting and Bookkeeping in Manufacturing Businesses

- Improved cost control through tracking and analyzing expenses, leading to increased profitability.

- Enhanced decision-making based on accurate and up-to-date financial data, enabling better pricing strategies and resource allocation.

- Optimized inventory management by monitoring levels and turnover ratios to avoid holding costs and stockouts.

- Outsourcing bookkeeping provides access to specialized expertise without hiring additional staff.

- Flexibility in scaling bookkeeping services according to business needs.

- Offshore outsourcing offers cost savings while maintaining high-quality services from experienced professionals.

Types of Manufacturing Businesses in Australia

- Food and Beverage Manufacturing: This industry produces a wide range of consumable goods, including packaged snacks, beverages, dairy products, and processed foods. Quality control is paramount to ensure product safety and freshness.

- Automotive Industry: Manufacturers in this sector produce cars, motorcycles, and other motor vehicles. The production process involves sophisticated equipment and skilled labor to achieve precision and high-quality vehicles.

- Pharmaceutical Industry: Businesses in this sector produce medications, vaccines, and medical devices. Stringent regulatory requirements are followed to ensure the effectiveness and safety of their products.

- Textile Manufacturing: This industry involves designing, sourcing, cutting, sewing, and creating textiles for clothing and other applications, such as interior design and industrial use.

- Chemical Manufacturing: Companies in this sector produce various chemicals used in a wide range of applications, including cleaning supplies, construction materials, and industrial processes.

- Plastics and Rubber Manufacturing: This involves the production of plastic products, packaging materials, and rubber goods.

- Furniture Manufacturing: Manufacturers produce furniture for residential, commercial, and industrial use.

- Electronics Manufacturing: This sector includes the production of electronic components, devices, and equipment.

- Printing and Publishing: Businesses in this category are involved in printing, publishing, and related services.

- Aerospace and Defense Manufacturing: Some companies produce aerospace and defense-related equipment, parts, and systems.

- Building and Construction Materials: This includes the production of building materials like cement, bricks, glass, and insulation products.

- Wood and Paper Products Manufacturing: Manufacturers in this sector produce wood products, paper, and paper-based packaging.

How does Meru accounting help in the manufacturing business?

Meru Accounting offers significant benefits to manufacturing businesses. Its precise and systematic approach ensures the accurate recording of financial transactions, encompassing raw material purchases, production costs, and finished goods sales. By maintaining detailed records, businesses can allocate costs effectively, providing a clearer understanding of the true cost of production. This enables better financial analysis, allowing manufacturers to evaluate profitability, identify cost-saving opportunities, and optimize production processes for improved efficiency.

For manufacturing businesses, inventory management is a critical aspect, and Meru Accounting proves invaluable in tracking and valuing inventories. With proper inventory management, businesses can reduce the risk of stockouts, minimize excess stock, and maintain optimal levels for smooth operations. Additionally, Meru Accounting promotes transparency and compliance with regulatory requirements, ensuring that financial transactions are well-documented and auditable.

Manufacturing businesses can leverage the insights from Meru Accounting for informed decision-making, aiding in growth and expansion endeavors. This comprehensive accounting system offers historical financial data, which is vital for budgeting, financial planning, and seeking external funding or investors. However, while Meru’s Accounting principles remain relevant, modern manufacturing businesses often integrate them into sophisticated accounting software and systems that provide real-time financial data and streamline accounting processes, enhancing the overall financial management experience.

Conclusion

Effective bookkeeping and accounting practices are essential for success in the competitive manufacturing industry. Regardless of the type of manufacturing business you have, accurate and timely financial management is essential to drive profitability and make informed decisions. Choosing whether to handle accounting in-house or outsource certain aspects is a decision that should be based on your business’s specific needs and resources. Outsourcing or offshoring can provide specialized expertise and allow your team to focus on core business activities.

Leveraging technology solutions like cloud-based software and collaborating with experienced professionals, such as those at Meru Accounting, who understand Australian tax laws, can streamline financial operations and ensure compliance. With Meru Accounting’s support, manufacturers can navigate complex financial matters, track costs, and analyze expenses, ultimately contributing to the growth and success of their businesses. Embracing sound bookkeeping principles and partnering with experts in manufacturing accounting will undoubtedly lead to a thriving manufacturing enterprise in Australia’s dynamic landscape.

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Bookkeeping for CPA(s)

Certified public accountants or CPAs are known as backbones of a business firm. They help a business to survive and stand in the market. They are financial experts. Their stronghold at accounting, taxation, and finance makes them feel that they don’t require any bookkeeping service to keep a check on all the updates and paperwork.

CPA(s) are very knowledgeable. But spending their time in compilation and updation of paperwork is not a part of their job. They can efficiently invest this time in looking up for new clients and strengthening of already made tie-ups with multiple business firms. CPA(s) often live under the misunderstanding that they need not hire a professional and invest extra money on bookkeeping.

This is an actual myth these days. Having a personalized bookkeeping service improvises the accountant’s productivity. Your work gets more organized and stays updated. Outsourcing accountant experts are well updated with all the latest technologies that are needed to thrive in the industry.

As an accountant, you shall have peace of mind if you know that your accounting processes are in safe hands. Your data is being accessed using the latest technologies. This becomes a major strength when your motto is to work with the maximum no. of clients.

A good bookkeeping service will know about software like Freshbooks, SageOne, Wave, Xero, Quickbooks, etc. When your accounts are with an expert, who is not just mending for paperwork, you are good to go. All these benefits prove the need for bookkeeping for a CPA’s growth and easy work processing.

The acronym CPA stands for Certified Public Accountants. A CPA is a certification issued by the American Institute of Certified Public Accountant (AICPA). A person certified as CPA acts as a financial advisor with a high degree of knowledge and experience in the field of accountancy. This certification is mostly preferred by the CA, CS, MBA Cost accountant, financial advisors for professional recognition.

CFA stands for Certified Financial Analyst certified by CFA institute whereas CPA stands for Certified Public Accountant certified by AICPA. The purpose CFA is to analyses different financial option and provides investments options to the key financial planner and upper management of investment companies, whereas CPA is trained accountant professional who assists in various accounting service and taxation. We can say CFA act as financial analyst whereas the role of the CPA is of a facilitator of the accounting process.

If an individual, business, firm, or organization needs help for the preparation of tax, they should hire a CPA. If they need assistance for financial planning and investment, then should hire a CFA.

The three E(s) of CPA are Education, Examination and Experience. These 3 E(s) are necessary to get licenses for CPA. Only passing out examination doesn’t make you eligible for a CPA license, you need to meet sufficient requirements to get a license. Contact to this site for more details https://www.aicpa.org/becomeacpa/cpaexam.html

An individual, business, or any organization needs assistance in finance, accounting and business require a CPA. A qualified CPA provides professional expertise and advice to your business.

CONTACT US FOR ANY QUESTIONS