Home » Industries » Education

Hire Remote Bookkeeper, Accountant , Tax return Preparer or Admin Person

Monthly Bookkeeping, Payroll, Financial Statements & Tax returns for Educational and Academic Institutions

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Bookkeeping Firms

- Business Owners & Startup Companies

Starting from AUD 700 for 40 hours months

Starting from AUD 2100 for 160 hours months

Hire Remote Team

Remote Bookkeeping & Accounting Services for every business Owners, Chartered Accountants, CPA firms & Bookkeepers.

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Bookkeeping Firms

- Business Owners & Startup Companies

Hire Remote Team

Bookkeeping software expertise

Our Services

We are a group of professionals who offer accounting and bookkeeping services to our clientele across the AU. We offer standard as well as tailored accounting and bookkeeping solutions based on the specific requirements of our clients, ensuring them the best results with our services.

Setting up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance.

Day to Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Year End Finalisation

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

Payroll Setup and Processing

This covers filing your Payroll through Single Touch Payroll system, TFN Declaration, Superannuation Return filing, Installment Activity Statement filing & PAYG Calculations.

GST in Australia

We shall reconcile your GST input Credit account and Output liability account.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

Bookkeeping for CPA's

We provide end to end bookkeeping solutions for CPA’s and bookkeepers in the AU.

BAS Returns

We deal with BAS very closely for our clients to ensure that GST claim is correctly calculated and Submitted Timely.

Annual Company Tax Return

We shall do your Individual & company Tax filing through your ATO login.

Why are we the 1st choice of AU Businesses for Accounting & Tax Return Preparation

Reduce 50% in Current Costs

You will see a Cost reduction of at least 40-50% as compared to local Bookkeeper or Accountant.

Self Hosted PMS

Our standardized processes and decent Project Management system helps to communicate with you clearly and efficiently.

Faster Turnaround

We generally reply to every emails same day or within maximum 24 hours.

Starting from

US $10 Per Hour Bookkeeping service

Detailed & Regular Work Updates

We send emails that carry all the necessary information you need to carry out business operations.

Monthly Meetings with CPA

We conduct monthly meetings with CPA’s for effective communication and understanding client needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization. .

Detailed Checklists

We prepare a well-defined checklist of all the requirements for you so that you don’t have any confusion.

High Quality of Work

Our Standardized Procedures and Checklists will ensure error free work. .

Cloud AddOns Expertise

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Gusto

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

Bookkeeping and accounting of the education industry in Australia

Unlocking the financial success of your education business is not just about delivering quality education. It’s also about efficiently managing your finances through effective bookkeeping and accounting practices. Whether you run a school, tutoring center, or online learning platform in Australia, having a solid grasp of bookkeeping and accounting can make all the difference in achieving long-term growth and profitability.

Understand the importance and power of accounting and bookkeeping. It can take your education business to the next level and provide a lot of benefits. Let’s explore the need of accounting and bookkeeping, the benefits they bring to education businesses, how to set up an effective system, compliance requirements specific to the sector in Australia, and more.

How bookkeeping and accounting are important in the education sector in Australia

Bookkeeping and accounting play a crucial role in the education sector in Australia, just as they do in any other industry. Efficient financial management is essential for educational institutions to operate smoothly, make informed decisions, and ensure compliance with financial regulations.

Here’s how bookkeeping and accounting are important in the education sector in Australia:

- Financial Record-Keeping: Bookkeeping involves recording and organizing financial transactions, such as tuition fees, government funding, and expenses on teaching materials and staff salaries. Accurate and detailed record-keeping is crucial for tracking income and expenses, which helps in budgeting and financial planning.

- Budgeting and Resource Allocation: Proper accounting practices allow educational institutions to create budgets based on their financial records. This enables them to allocate resources effectively, ensuring that funds are appropriately distributed across various departments and programs.

- Grant Management: Many educational institutions receive grants and funding from government bodies or private organizations. Bookkeeping and accounting help in tracking and managing these grants, ensuring that they are utilized for their intended purposes and that all reporting requirements are met.

- Tax Compliance: Like any other business, educational institutions have tax obligations. Bookkeeping ensures that all financial transactions are properly recorded and categorized, making it easier to prepare accurate financial statements and meet tax compliance requirements.

- Financial Reporting: Accounting generates financial statements, such as balance sheets and income statements, which provide insights into the institution's financial health and performance. These reports are valuable for stakeholders, including school administrators, boards, and government authorities.

- Payroll Management: Educational institutions have a significant workforce, including teachers, administrative staff, and support staff. Bookkeeping and accounting help manage payroll efficiently, ensuring that all employees are paid accurately and on time.

- Cost Control and Financial Analysis: By analyzing financial data, educational institutions can identify areas where costs can be reduced and resources better utilized. This leads to better financial efficiency and sustainability.

- Funding Decisions: When seeking additional funding or loans, financial records, and reports are crucial for demonstrating the institution's financial stability and reliability to potential investors or lenders.

- Long-term Financial Planning: With proper bookkeeping and accounting practices, educational institutions can engage in long-term financial planning, such as setting financial goals, creating reserves, and investing in infrastructure and facilities.

- Risk Management: By maintaining accurate financial records and conducting regular financial analyses, educational institutions can identify potential financial risks and take proactive measures to mitigate them.

Professional tax solution for the Educational Institutions

The tax obligation of the education sector is getting more and more complex due to supplemental revenue streams and dynamic regulatory controls. The tax returns are also affected by the change in government funding. Apart from the changes in state and federal tax rules, their applicability to different forms of the educational institute such as pre-schools, nurseries, etc. also makes it difficult to follow up the taxation process.

Meru Accounting is committed to providing hassle-free tax preparation for educational institutes. Our dedicated tax professionals assist in grant compliance, financial reporting, and tax-exempt status. The education institutions need a monthly analysis of profits to ensure that the business sustains in the long run. We also take care of the bookkeeping business by timely invoicing the students, which ensures that the revenue is perfectly reconciled. Therefore, we take care of the bookkeeping for your education business from recording student master to reporting profitability per cost center.

Tax services

- Exemption status application

- State and Federal filling preparation

- Filing and preparation of Form-990, 990-T, 5500

- Representation before IRS

- Employee benefit consulting

- Fundraising reporting

- Tax deduction and maximum refund

- PAYE and GST

Tax advisors can also assist in

- Accounting and Bookkeeping

- Adherence to regulations

- Capitalization of fiscal opportunities

- Keep updating about emerging issues and the impact of new accounting standards

- Future planning

- Keep updating on the evolving federal, multi-state, and international tax regulations

- Updating about the new tax incentive schemes

How does Meru accounting help in the education business?

Work with us to save money, stay compliant and plan your future. Meru Accounting is an online accounting and tax preparation firm having a global presence.

- Experience: Expertise comes with experience. Our team has been providing tax solutions to government institutes, community colleges, universities, district schools, etc. Thus we got command over the taxation rule and regulation of the education sector. Our vast experience helps to provide hassle-free returns.

- Qualified People: We have a team that holds a professional qualification in the accounting field. We are a team of CPAs, Character Accountants, and Accountants.

- Affordable: We offer professional service that doesn’t damage your fund. We only price $ US 15 for each hour of service. The hourly rate system not only cut the cost that would end up investing the non-productive hours of the in-house accountant team.

- Virtual Accounting: The administrative and networking costs get eliminated when a virtual accountant is hired instead of an in-house accountant. We provide anytime remote access to the documents and financial information plus allowing social distancing in the pandemic times.

- Accounting Software Expertise: Tax professionals at Meru Accounting are experienced in using various cloud-based accounting software such as XERO, MYOB, QuickBooks, etc. We are a XERO-certified silver partner. We also help to convert to XERO software.

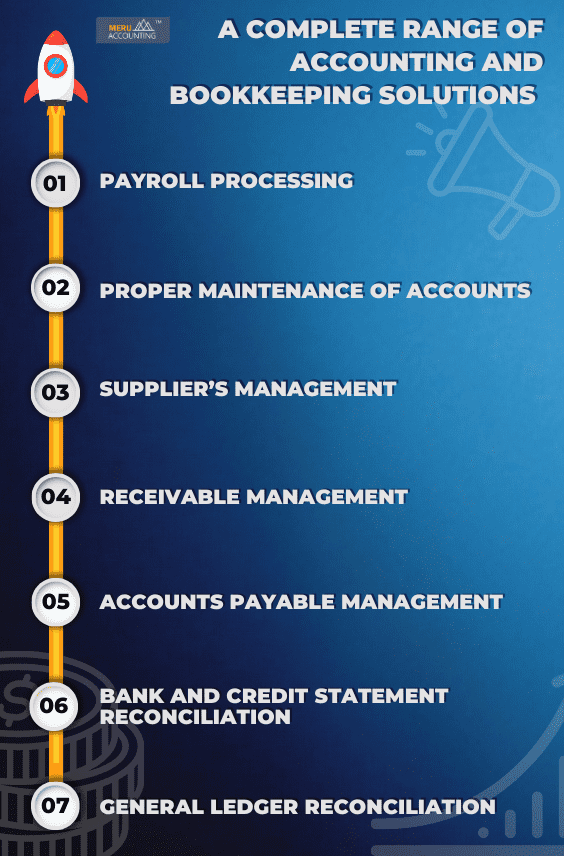

We also provide a complete range of accounting and bookkeeping solutions

We are aware of the financial issues that the education sector faces. For addressing such problems, our firm also provides financial services to schools, non-profit and public colleges, and universities. We are aware of the financial issues that the education sector faces. For addressing such problems, our firm also provides financial services to schools, non-profit and public colleges, and universities.

Benefits of bookkeeping and accounting in the education sector of Australia

Bookkeeping and accounting play a crucial role in the education sector in Australia, providing numerous benefits for educational institutions. Here are some key advantages:

- Financial Transparency: Proper bookkeeping and accounting practices ensure transparency in the financial management of educational institutions. Accurate records of income, expenses, and budgets offer a clear view of the institution's financial health.

- Effective Budgeting: With accurate financial data, educational institutions can create well-informed budgets. Budgeting becomes more efficient, allowing for better allocation of resources to support various educational programs and initiatives.

- Compliance with Regulations: The education sector is subject to specific financial regulations and reporting requirements. Bookkeeping and accounting help institutions adhere to these regulations, ensuring compliance with tax laws and financial reporting standards.

- Resource Allocation: Financial records enable institutions to identify cost-saving opportunities and areas where resources can be allocated more effectively. This ensures that funds are directed toward improving the overall quality of education.

- Decision Making: Timely and accurate financial reports empower educational leaders to make informed decisions about investments, expansions, and improvements in infrastructure and academic resources.

- Grant Management: Educational institutions often receive grants and funding from various sources. Proper accounting helps in tracking and managing these funds, ensuring they are used for their designated purposes.

- Planning and Forecasting: With historical financial data at hand, educational institutions can make informed projections about future expenses, revenues, and funding needs. This aids in long-term planning and sustainable growth.

- Cost Control: Bookkeeping and accounting allow institutions to identify areas of unnecessary expenditure and implement cost-control measures to maximize financial efficiency.

- Improved Governance: Accurate financial reporting enhances governance practices within educational institutions. It provides stakeholders with a clear understanding of the institution's financial performance and ensures accountability.

- Effective Fundraising: Well-maintained financial records are crucial for attracting donors and sponsors. Donors are more likely to contribute to an institution with transparent financial management and a solid track record.

Conclusion

In the fast-evolving landscape of the education business sector in Australia, Meru Accounting stands as the catalyst for financial excellence. Our specialized bookkeeping and accounting services offer educational institutions a streamlined and efficient approach to managing their finances, ensuring accurate reporting, and maintaining compliance with regulatory standards. By entrusting your financial management to Meru Accounting, educational institutions can focus on their core mission of nurturing young minds. Our team of skilled professionals is well-versed in the unique financial intricacies of the education industry, providing tailored solutions that meet your specific needs.

Outsourcing to Meru Accounting presents a lot of advantages, including cost-effectiveness, expert guidance, and increased efficiency. We leverage the latest digital solutions, such as cloud-based accounting software, to enhance accuracy and save time. As the demand for qualified bookkeepers and accountants in the education sector grows, Meru Accounting is at the forefront of offering valuable career opportunities. By acquiring the necessary certifications and staying updated with industry trends, aspiring professionals can make a significant impact in shaping the future of education.

At Meru Accounting, we believe in empowering education businesses with the financial prowess they need to thrive. Partner with us today and together, let’s illuminate the path to financial excellence for educational institutions across Australia!

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Bookkeeping for CPA(s)

Certified public accountants or CPAs are known as backbones of a business firm. They help a business to survive and stand in the market. They are financial experts. Their stronghold at accounting, taxation, and finance makes them feel that they don’t require any bookkeeping service to keep a check on all the updates and paperwork.

CPA(s) are very knowledgeable. But spending their time in compilation and updation of paperwork is not a part of their job. They can efficiently invest this time in looking up for new clients and strengthening of already made tie-ups with multiple business firms. CPA(s) often live under the misunderstanding that they need not hire a professional and invest extra money on bookkeeping.

This is an actual myth these days. Having a personalized bookkeeping service improvises the accountant’s productivity. Your work gets more organized and stays updated. Outsourcing accountant experts are well updated with all the latest technologies that are needed to thrive in the industry.

As an accountant, you shall have peace of mind if you know that your accounting processes are in safe hands. Your data is being accessed using the latest technologies. This becomes a major strength when your motto is to work with the maximum no. of clients.

A good bookkeeping service will know about software like Freshbooks, SageOne, Wave, Xero, Quickbooks, etc. When your accounts are with an expert, who is not just mending for paperwork, you are good to go. All these benefits prove the need for bookkeeping for a CPA’s growth and easy work processing.

The acronym CPA stands for Certified Public Accountants. A CPA is a certification issued by the American Institute of Certified Public Accountant (AICPA). A person certified as CPA acts as a financial advisor with a high degree of knowledge and experience in the field of accountancy. This certification is mostly preferred by the CA, CS, MBA Cost accountant, financial advisors for professional recognition.

CFA stands for Certified Financial Analyst certified by CFA institute whereas CPA stands for Certified Public Accountant certified by AICPA. The purpose CFA is to analyses different financial option and provides investments options to the key financial planner and upper management of investment companies, whereas CPA is trained accountant professional who assists in various accounting service and taxation. We can say CFA act as financial analyst whereas the role of the CPA is of a facilitator of the accounting process.

If an individual, business, firm, or organization needs help for the preparation of tax, they should hire a CPA. If they need assistance for financial planning and investment, then should hire a CFA.

The three E(s) of CPA are Education, Examination and Experience. These 3 E(s) are necessary to get licenses for CPA. Only passing out examination doesn’t make you eligible for a CPA license, you need to meet sufficient requirements to get a license. Contact to this site for more details https://www.aicpa.org/becomeacpa/cpaexam.html

An individual, business, or any organization needs assistance in finance, accounting and business require a CPA. A qualified CPA provides professional expertise and advice to your business.

CONTACT US FOR ANY QUESTIONS